Personal finance is something every adult needs to master. Whether we like it or not, our financial status determines much of our lives. You may not need money to be happy but it can certainly help prevent you from getting cold and hungry. The money will allow you to do what you want, get what you need, and go where you want to be. Most of us will need to work hard for every dollar. There is only a finite amount in our accounts and seemingly endless things that we have to pay for. Below are some of the best personal finance tips for stress reduction:

Build an Emergency Fund

The best thing that you can do for yourself is to give the Future You money to ride out the tough patches in life. No one knows when you will suddenly be confronted with a medical emergency, a job loss, a divorce, a business collapse, a house fire, and so on. Any of these can send a person to the depths of despair, especially if there isn’t enough funds to deal with the situation. An emergency fund will make it a bit easier to breathe despite the severity of the situation. This should be worth 6 months of your expenses, but you can aim for 12 months or more depending on your comfort level.

Stop Following the Trends

Do you find yourself spending much more than you should? Is your shopping cart filled with a long list of items that you simply added on a whim? Maybe you saw something cool on TV or on your social media feed. Perhaps you saw a friend wearing nice shoes or you noticed people on the street sporting a certain brand. Sure, you can try to keep up with the trends but you will always be chasing something fleeting. Trends come and go. Your money is gone forever. If it I not necessary, then just save the money and add it to your

best personal finance tips.

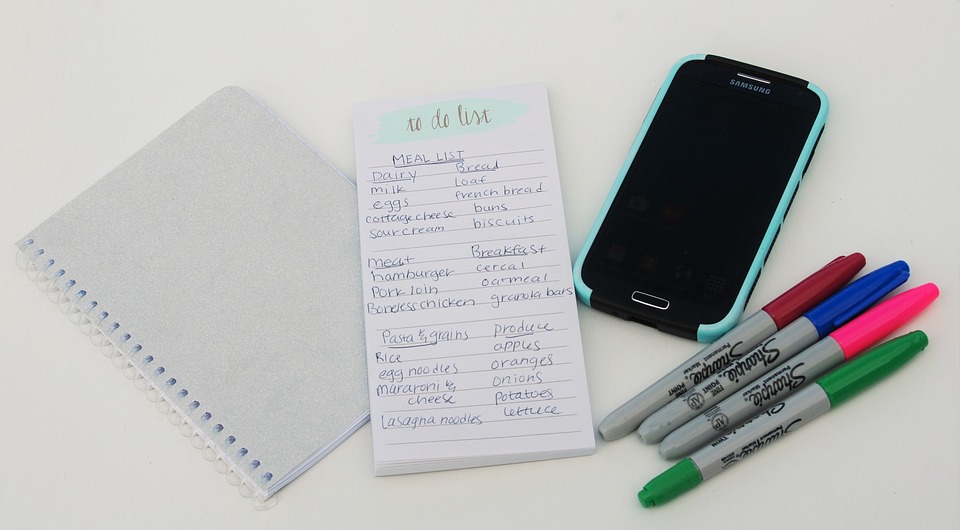

Make a Budget and Honor It

Necessities should be placed on a budget so that you can set aside enough money each week or each month, depending on when you pay for them. Bills like rent, water, gas, and energy should be fairly predictable. If you have credit card debts, mortgages, car notes, and other loan payments, then plan for them as well. Make sure that you have enough for all these. Look back at your grocery shopping list and your clothing budget. Honor what you wrote by avoiding impulse purchases.