Apps

Overview Of Publish IOs App

Apps developed need to be launched in an App store, this is done by publishing them on the App store

Apps developed need to be launched in an App store, this is done by publishing them on the App store

Are you considering owning a car through a car loan? Well, this guide will help you to understand the main

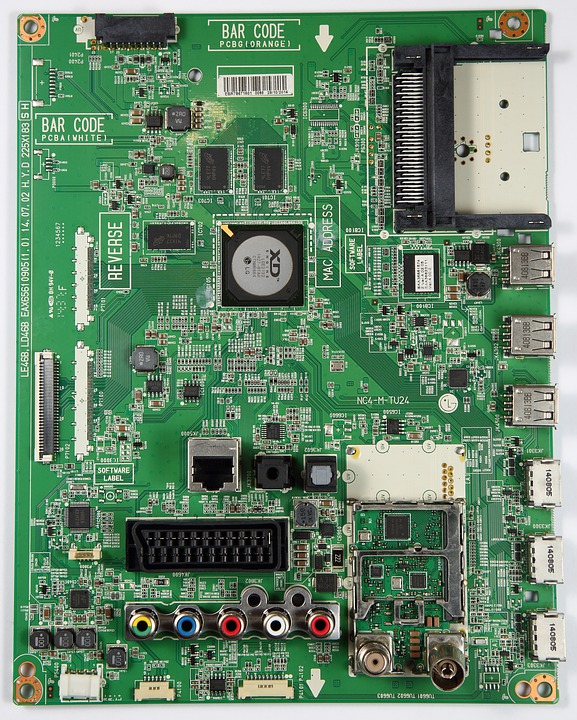

Before starting the manufacturing of an electronic product, an engineer always gets help from fast PCB prototyping. Printed Circuit Board

A bad credit car loans NZ is a serious inconvenience but it is not the end of the world. If

Copyright © 2025 | Powered by Word-Weight

Copyright © 2025 | Powered by Word-Weight